Consumer Alert: The debt collector is calling. Here’s what you should do

[anvplayer video=”5110675″ station=”998131″]

ROCHESTER, N.Y. (WHEC) — The year was 1998. Rochester was rocked by the news that 1,400 Xerox employees would lose their jobs in a major restructuring of the company. Betty Maxey was one of them.

"It was very traumatizing,” said Maxey who had worked for Xerox for 20 years. She said she searched frantically for another job, the bills kept piling up. So she filed for Chapter 13 bankruptcy protection and worked hard to pay off the negotiated debt settlements as her attorney instructed.

And according to her credit report, Maxey is now debt-free.

"I have an 800 credit score now,” Maxey said proudly.

It’s an excellent score. Maxey has been working with a local non-profit to buy a home, and her credit report will serve as proof of financial stability.

[News10NBC]

She laughed as I checked her credit report that showed that her only debt totaled just $23. But her laughter belies the burden borne through years of sacrifice. She works part-time for RCSD in the district’s central kitchen, walking blocks to and from the bus stop, determined to live within her meager means. So a letter she recently got from the school district stopped her cold.

The school district’s legal department wrote to inform her that a debt collector has filed a subpoena for her employment records, the first step toward garnishing her wages. It’s for a Chase credit card debt that’s more than two decades old.

"I couldn’t believe it,” Maxey said. “I thought this went to bankruptcy court. They [the debt collector] said no it didn’t!”

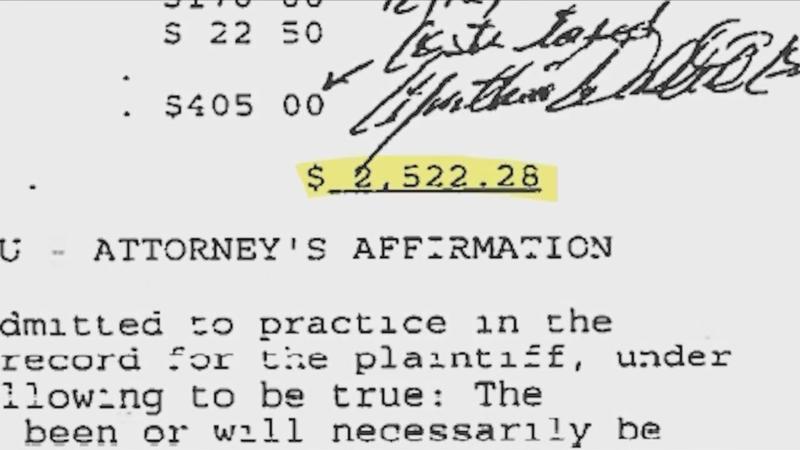

That’s because unbeknownst to Maxey, Chase sued before she filed bankruptcy. The bank won a default judgment for her unpaid balance of $2,522.28.

Ashley Dodd, a Chase spokesperson confirmed, "We filed litigation on this debt in 2001 and sold it in 2002. We have not had a legal or financial interest in the debt since then."

Dodd is referring to a common practice. Banks sell old debt for pennies on the dollar. The buyer then tries to collect the debt. That’s what happened to Maxey. For years she’s been getting letters that appear to be from Chase Bank. But when she contacted the bank she was assured that she didn’t owe Chase anything.

So that begs the question. If the letters aren’t from Chase, who are they from? And is the collection of this two-decade-old debt even legal?

With Maxey on the line, I called the debt collector, Maidenbaum & Associates and spoke to Amir Collazo. His LinkedIn page says he’s a legal investigator. He abruptly said he didn’t talk to reporters, but I kept talking.

I asked him if the debt was legal, and he hung up on me. So the next day, Maxey and I tried to call him again.

This time, Betty did all the talking. When she asked him about the debt, he said he wouldn’t talk to her because a reporter might be listening. At that point, Maxey had enough.

"Well if you got nothing to hide, you don’t have to worry about reporters,” she said. “You don’t have to worry about no reporters if you ain’t got nothing to hide!”

And again, he hung up without answering questions. We called three times and sent eight emails. I got no response.

In those emails, I asked the partner at Maidenbaum & Assoociates, Jeffrey Maidenbaum, about a case I found strikingly similar to Maxey’s. A man named Keith Pitman sued Maidenbaum for deceptive debt collection practices. Like Maxey, Chase had sued Pitman and was awarded a default judgment for old credit card debt. Chase later sold the debt, and years later, Maidenbaum tried to collect.

Betty Maxey – Keith Pitman Lawsuit Against Maidenbaum by News10NBC on Scribd

"And the original documents Maidenbaum sent made it look as though they were collecting on behalf of Chase,” said Matthew Parham, a lawyer at the Western New York Law Center in Buffalo and Pitman’s attorney.

But Maidenbaum was not representing Chase. Instead, the firm was representing the company that bought the debt, Account Receivable System LLC.

"There should never be a situation where a debt collector is only identifying the original creditor but not the current creditor,” Parham said. “When you’re collecting a debt you have to identify who you’re working on behalf of.”

And he says failure to do so is false, deceptive, misleading, unconscionable, and a violation of state and federal law. Maxey’s debt is also very old. Is pursuing a two-decade-old debt legal?

"Generally a judgment is good for 20 years from when it was entered," Parham said.

Remember, Chase legally sued Maxey in 2001 and was awarded a judgment. So a debt collector would have 20 years to collect. But many technical, legal questions remain concerning whether Maidenbaum’s time is up in this case. And Maxey is not giving up without a fight.

"I think you shouldn’t do nobody like that, especially hardworking people,” Maxey said. “Nobody should get caught up in this. And I feel they’re just so wrong."

Following my investigation, Maxey decided to seek legal help at Legal Assistance of Western New York in Rochester which provides free legal help to qualifying individuals.

Here’s Deanna’s Do list for when a debt collector calls you:

- Take great records. Ask for their name, the name of the company, and note the date and time.

- Verify only your mailing address. Give no other personal information.

- Tell them they must validate the debt and ask for their mailing address.

- Send a letter asking them to send written validation of the debt. They must tell you who the current creditor is as well as the original creditor.

Also, the governor signed into law a measure that makes it illegal for a creditor to sue you for a debt that’s more than three years old. So never make a payment. Often creditors will ask for a good faith payment just so they can extend the statute of limitations.

Here’s more great advice from Anna Anderson, Supervising Attorney of the Regional Consumer Law Unit at Legal Assistance of Western New York, Inc.:

The National Association of Consumer Advocates provides free referrals to consumer lawyers in the State at www.consumeradvocates.org/findanattorney/. LawNY also provides free legal assistance to low-income consumers with debt collection issues. LawNY’s phone number is 585-325-2520 and the website is www.lawny.org.

It is important to know your rights when contacted by debt collectors, as many debt collectors don’t actually have proof that they have the right to collect on your alleged debt (as is the case here). Even if you think you may owe money, do not send payments in response to an unknown caller’s demands. Contact your original creditor to ask whether or not your account is in collection, which company it has hired to collect on your account, or which company has purchased your debt. Collectors may be contacting you about debts that are beyond the statute of limitations, or for debts that you do not owe. If you are unsure if a lawsuit or judgment has been filed against you, contact the Court Clerk in the city or County where you live to see if there are any outstanding cases in your name. In many cases consumers are never notified that they have been sued. If you are sued, contact a lawyer right away, as you only have a short time to respond before a default judgment is entered. You do not automatically get a court date. Talking to a lawyer about your rights is always the best idea, so you don’t fall victim to an illegal collection scheme.

Consumers should also report violations of NYS and federal debt collection rules to the NYS Department of Financial Services, the NYS Attorney General’s Office, and the Consumer Financial Protection Bureau. Free resources for consumers dealing with debt collectors are available on all of these agencies’ websites, in addition to LawNY’s website.