Consumer Alert: Thieves are using an ingenious way to steal your driver’s license info. And that’s when the consumer nightmare begins.

[anvplayer video=”5019965″ station=”998131″]

ROCHESTER, N.Y. (WHEC) — In Wednesday’s consumer alert I’m examining those bills that could cost consumers far more than money.

You’ll remember on Tuesday I told you that New Yorkers are getting bills in the mail for insurance they didn’t buy.

And those bills are expensive. I’m not talking about the bills themselves. I’m talking about what this fateful financial fraud could cost consumers in the long run.

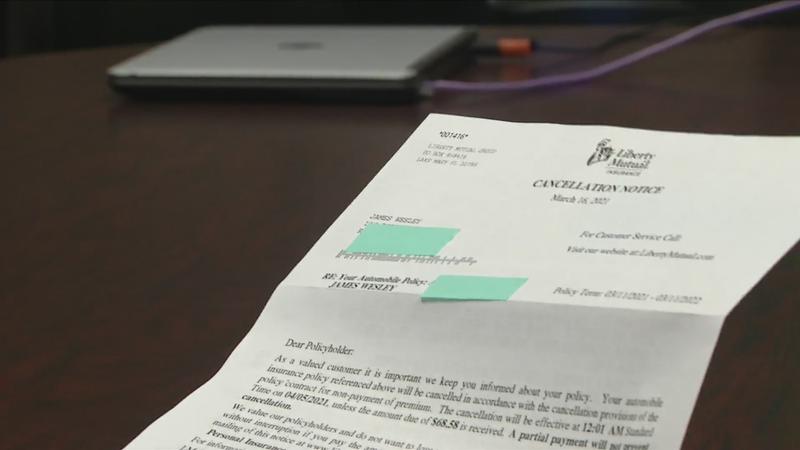

I closely examined a bundle of bills that looked real. That’s because it was indeed a bundle of real bills requesting payment for real auto insurance policies. But the consumers getting those bills don’t actually owe this insurer any money.

That’s because thieves are using stolen personal information from innocent New Yorkers and buying Liberty Mutual auto insurance. Rochester-area resident Jim Wesley is one of many Empire State residents who got an unpleasant surprise in the mail.

[News10NBC]

"It was two requests for payments. Two billing statements for auto insurance policies saying please pay this bill or we will cancel the policy,” Wesley said.

But Wesley hadn’t bought Liberty Mutual insurance. A scammer bought it with Wesley’s stolen personal information.

"The agents told me that they have thousands and thousands of applications that have been processed online,” said Ken Mollins, a Long Island attorney representing one of the New York scam victims.

"And when you process the information online, they ask for the number on your driver’s license. And if you don’t put it in, Liberty then goes to the DMV on the basis of the application and gets that information. And then the scammers get it from Liberty," Mollins said.

And that spells trouble. When a scammer has your driver’s license number, the rippling repercussions of that rip-off can be disastrous.

"There are now thousands and thousands of people who are now open to significant fraud because you can get a loan using a driver’s license number," Mollins said.

And thieves can file a fraudulent claim for unemployment insurance in your name, making New York’s bad unemployment fraud problem far worse.

"The amount of money the state is paying out in unemployment fraud can probably help trim the national budget,” Mollins speculated. “That’s how much it is. It’s so extensive."

The state DMV as well as the Office of Financial Services are aware of this fraud.

A DMV spokesman told me the department is working with affected consumers. As for Liberty Mutual, I wanted to know if they’ve changed their application process so thieves can’t continue to do this. Liberty Mutual wouldn’t answer that question.

Instead, a spokesman wrote, “We are following state notification regulations when contacting potentially impacted consumers.”

If you get one of these bills, don’t throw it away.

Contact the insurer immediately and check, re-check and check your credit report again.

And that’s your consumer alert.