Consumer Alert: Buy Now Pay Later? Before you click, read this first.

[anvplayer video=”5070654″ station=”998131″]

ROCHESTER, N.Y. (WHEC) — Prices are high. Christmas is coming, and temptation abounds. One of them is there almost every time you buy something online. They’re "buy now pay later" loans, and while some are interest-free under some conditions, this is not your mother’s layaway.

Layaway lets you pay on the product interest-free then you get it when it’s paid off. These new-fangled products are loans and they let you get the item now and pay for it in installments later. But financial experts say they can be dangerous.

You see them everywhere. For example, I found a cool Power Wheels pickup truck on Walmart.com. It’s almost $400.

Beneath the price is an offer. You can get it now and pay only $3 a month through a company called Affirm, but Affirm charges you an interest rate of 20%. That’s as bad as putting those new wheels on a credit card. If a payment is late Affirm boasts that it doesn’t charge late fees. But it can ding your credit and ban you from using their service again.

Lots of companies are in the buy now pay later business these days. I found a Coach bag listed for $300 on the upscale resale site Mecari.

[News10NBC]

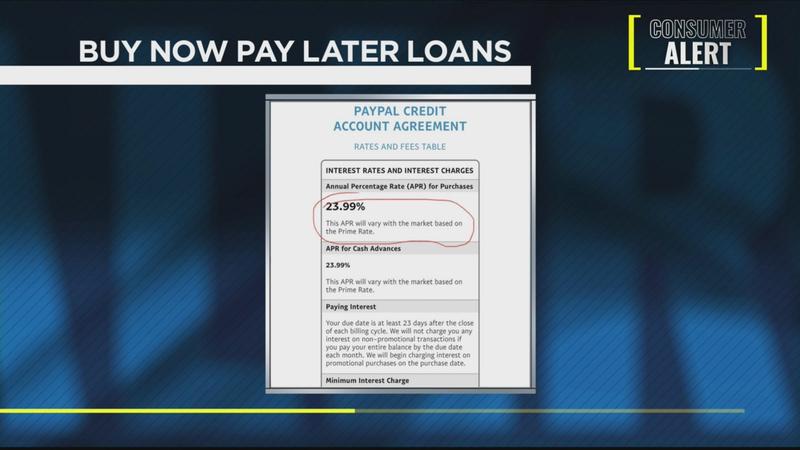

Beneath the price is an offer from PayPal credit. You can have the bag now for just four payments of $75. But there’s a catch. Those payments have to be made every two weeks.

That’s about $150. And if those payments are too steep, you can lower your monthly payment and finance longer, to the tune of 24% interest and late fees up to $40 a pop. So before you sign on the dotted line, Matt Schulz, Chief Industry Analyst at LendingTree has advice.

"It’s really one of those things that you need to read up on before you apply for the loan because nobody goes into a loan thinking that they’re going to pay late on it,” Schultz said. “But we all know that the reality is that those things happen so if that’s at all a concern for you, it’s a good move to understand what those potential fees are before you apply."

And here’s something else to think about. You’re taking out the loan from a different company than the one selling you the product. So what happens if you have to return the product? It’s not like getting your money back from your credit card company. Consumers complain that it’s often a long, arduous, unpleasant process.

Here’s the upside to these loans: They’re easy to get. They sometimes only require a soft credit check, and if you pay on time, they’re sometimes interest-free. But the devil is in the details, and in the case of these loans, those details are in the fine print.