Consumer Alert: Did you get a bill for auto insurance you didn’t buy? Your identity may have been stolen.

[anvplayer video=”5030717″ station=”998131″]

ROCHESTER, N.Y. (WHEC) — I’m alerting you to thieves stealing your identity through auto insurers’ websites. It’s a story I broke last month right here on News10NBC.

I’ve now learned this theft stretches far beyond the borders of the Empire State. It’s happening in California too.

Last month I brought you the story of Penn Yan resident Kathy Bower. She’s one of the thousands of New Yorkers who got an unpleasant surprise in the mail, a notice regarding auto insurance she never bought.

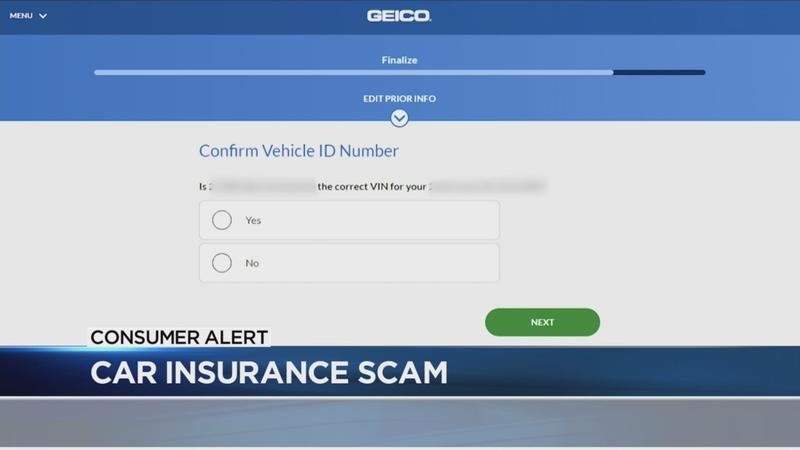

My investigations uncovered three auto insurers’ websites through which thieves accessed the driver’s license numbers of innocent New Yorkers. In some cases it was easy. Thieves simply applied for auto insurance. When I tested the systems using only my name and address, GEICO’s website auto-filled all of my personal information, including my driver’s license number. And with stolen driver’s license numbers, thieves have been filing fraudulent unemployment claims.

I immediately notified the New York Department of Financial Services. And days later, I learned GEICO’s website no longer auto-filled your driver’s license number. But it took the company months to fix the problem.

[News10NBC]

California law requires businesses to inform the attorney general when there’s been a data breach.

So a few weeks ago, GEICO sent the California A.G. the notice that it sent to customers. The letter acknowledges the fact that thieves had been able to access driver’s license numbers and used that information to file fraudulent unemployment claims. It also says GEICO has fixed its security flaws and is offering customers a year of identity theft protection.

But for some customers, that is not enough. I found a court action filed a few weeks ago that names GEICO as the defendant.

The plaintiffs in the case are asking a judge to certify their case as a class-action lawsuit. So while GEICO says it has fixed the problem, for thousands, the damage is already done. Their personal information is already exposed.

If you get a bill for auto insurance you didn’t buy, it’s imperative that you take the following steps:

- Call the fraud departments of each insurer.

- Progressive – 877-238-5194 (option 2).

- GEICO – 1-800-824-5404 ext. 3313.

- Liberty Mutual 1-617-357-9500.

- Call the DMV’s Insurance Services Bureau at 1-518-474-0700 to make sure it has the right auto insurance listed because the DMV may now believe you’ve changed your insurance.

- Check your credit with all three agencies – Transunion, Equifax, and Experian, here.

- Freeze your credit with all three. We know your identity is now compromised. The freeze assures us that thieves can’t open new lines of credit in your name.

- Report this crime to the New York State Department of Financial Services here.

A spokesman with the department told me they’re actively investigating these cases.

And that’s your consumer alert.