Consumer Alert: Protecting Your Cash and Credit in College. Part 3: Refinancing vs. consolidating your student loans

[anvplayer video=”5039107″ station=”998131″]

ROCHESTER, N.Y. (WHEC) — All week long we’ve been protecting your cash and credit while in college. Wednesday’s topic is your student loan.

If you have a degree it’s very likely that you have a loan. According to the latest numbers from the Federal Reserve, in 2019, 69% of college students had a student loan and graduated with an average debt of almost $30,000.

So here’s a big piece of advice for current students. If you’ve taken out a private loan, try to make interest-only payments on that loan while you’re in school. If you have a federally-backed loan, interest is deferred until you graduate.

Here’s another issue to think about. After graduation, how do you best tackle that debt? Should you consolidate your loans or refinance? That’s a great question for the experts at Experian.

"When you refinance, you get a new loan essentially with a lower interest rate with that lender," said Rod Griffin, Senior Director of Consumer Education at Experian. “When you consolidate a student loan, you may have multiple student loans, and you’re working with a lender to get a single loan that pays off all of them that combines them into one loan that you pay over time."

[News10NBC]

Let’s take a look at two scenarios. Imagine you have private loans and want a lower monthly payment. Refinancing with a private lender may be your best option because you’ll likely save money by getting a lower interest rate now while rates are at historic lows.

But what if you have several federal student loans? You may want to consolidate them into one federal loan, leaving you eligible for federal programs like income-driven repayment plans or loan forgiveness.

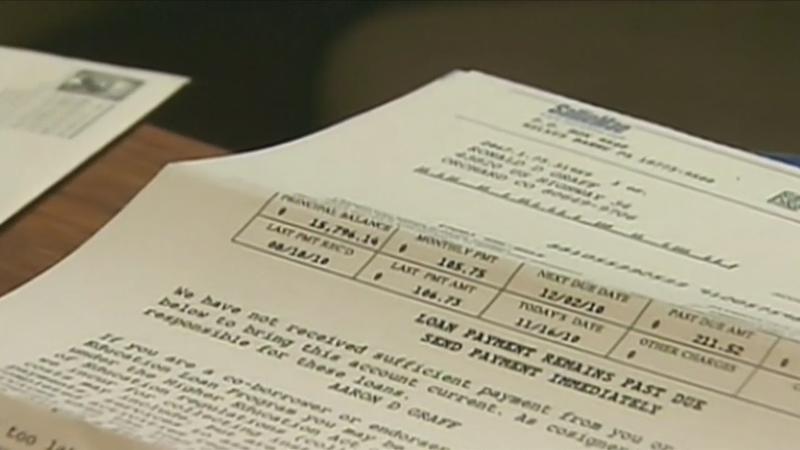

Let’s take a look at Paul’s conundrum. Paul is a News10 NBC viewer. He sent me an email that read in part, "recently I asked for an accounting of how my (student loan) payments were applied… In a 2 year period, all of my payments went to interest, and nothing went to the principal."

This is called a negative amortizing loan, and this is bad. It’s when your monthly minimum payment isn’t enough to pay down the principal, only the interest. So you’re not paying down any of the original debt. So should Paul refinance the loan to get a lower interest rate and lower monthly payments? Did his loan servicer make a mistake? That’s something I’m going to investigate. I’ll keep you posted.

If you have issues with your loan servicer, you can contact the CFPB — Office of Student Loan Ombudsman, the U.S. Department of Education / Federal Student Aid, the National Consumer Law Center, the NY Attorney General or your state’s attorney general, or the NY Department of Education.

Federally backed loans provide a number of options for loan relief. Click here to learn more about them.