Consumer Alert: The advance child tax credit. Your questions answered.

[News10NBC]

Editor’s note: This story has been updated to clarify how the unenrollment process works.

ROCHESTER, N.Y. (WHEC) — Today I’m alerting you to your child tax credit, your cash and your questions.

I told you Monday that some of you may want to opt out of getting those monthly advance payments on your child tax credit. I heard from so many of you with questions and concerns.

I think Tom’s question sums up many of them. Tom is a tax preparer and he wrote, "I do taxes for several people for free and had a call last night that they thought that if they owed the IRS money at filing time, they would have to pay back the full amount of the credit; every dime. They were panicking that they needed to opt-out by midnight."

Thanks for writing Tom. I should have been more clear. Not everyone who owes money come tax time will have to pay back all of their advance child credit payments. But that could be the case for some. I’ve heard from many of you who had incomes that were artificially low in 2020 because you were unemployed during the pandemic. Now you’re employed again and your income has greatly increased. But the government is basing your income eligibility for the child tax credit on your 2020 tax filing. So you could end up having to pay back those monthly payments come tax time.

To be clear, the amount you have to pay back depends on what you owe.

Let’s say a family with two school-aged children had a 2020 income of $100,000. That means they’re eligible for a tax credit of $3,000 per child for a total of $6,000. The IRS will pay that family half this year. So they’ll get monthly payments totaling $3,000 by this December.

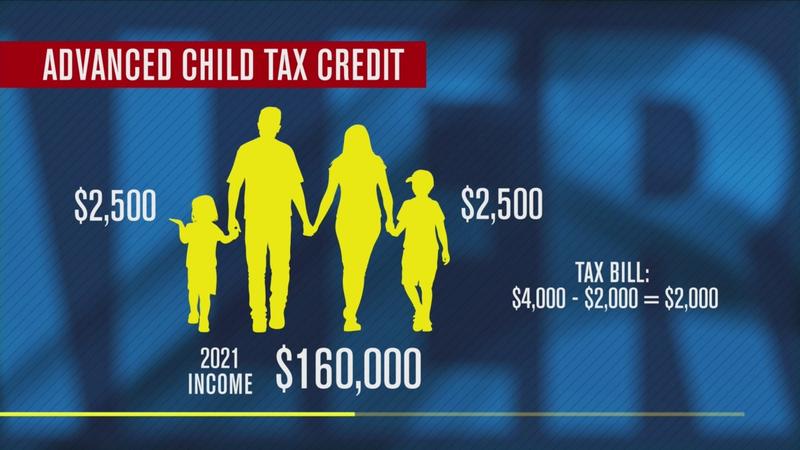

But in 2021, let’s say mom got a new job and now the family’s income is $160,000. So this family is now only eligible for a tax credit of $5,500 rather than $6,000. And let’s say when they file, they discover they owe $4,000 without the tax credit. So when they subtract their tax credit based on their 2021 taxes, they now can only subtract $2,500. Remember, They’ve already been paid $3,000. So now they owe $1,500. Had they opted out of monthly payments, they would have gotten a refund of $1,500.

I heard from so many of you who told me all this is about as clear as mud. I get it. It’s certainly not easy to explain the inner workings of the IRS on television, but it’s so important I thought we needed to talk about it. And I wrote the IRS telling them they need to make this easier for consumers by providing an online child tax credit calculator.

So I was on a mission Tuesday to find you one, and c/net and Kiplinger both have great ones. You just plug in your income, the number of kids and their ages, and the calculator does the math for you.

Also, I heard from many of you who weren’t sure if you should opt-out of those monthly payments. Don’t worry. You have an opportunity every month. The IRS calls it unenrolling. The deadline to unenroll before the August payment is Aug. 2.

I especially love our tax preparers. Thanks, Tom! Keep writing, and I’ll keep doing my best to keep you informed.